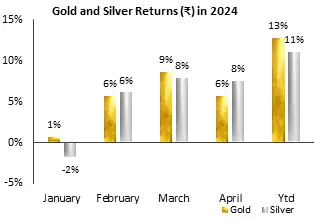

In comparison, an investment in gold during the same period would have grown by 24.63%.

As investors look to 2025, many may be pondering: will silver continue its upward trajectory and surpass gold?

Silver’s stellar run: A strong start but not without volatility

Silver’s eye-catching performance in 2024 has sparked renewed interest among investors seeking alternatives to traditional assets.

Value Research’s report highlights that, while silver can deliver strong short-term gains, it has historically displayed much more volatility than gold.

Over the past five years, silver’s returns have swung from as low as -2% to as high as 21% annually, compared to gold’s more stable range of 7% to 19%.

Both metals have yielded an average return of 12% over this period, but gold has maintained a steadier pace.

It has outperformed silver in 11 of the past 17 years, the report said.

The sharp fluctuations in silver’s performance make it a more volatile choice for long-term investors.

According to Value Research, silver’s standard deviation-a key measure of price stability-stays above 25% nearly 90% of the time, whereas gold maintains a much narrower volatility range of 11% to 14%.

This price stability makes gold a safer hedge against market swings, especially for conservative investors.

Portfolio strategy: Why gold remains the preferred hedge

For those wondering whether silver deserves a larger share in a balanced portfolio, insights from Capitalmind’s report suggest otherwise.

Their research on optimal asset allocation stresses silver’s limited contribution to overall portfolio stability. A recommended portfolio composition would be 62% gold, 35% equities, and just 3% silver, balancing return potential with reduced volatility.

Anoop Vijaykumar, Head of Research at Capitalmind, notes, “Gold, when paired with equities, adds stability and mitigates risk during turbulent market periods, while silver’s volatility limits its role in achieving long-term balance.”

Silver’s demand and price drivers

Despite its volatility, silver has some strong tailwinds for 2025.

The Federal Reserve’s recent rate cut could spark further demand for precious metals, as lower rates tend to support commodities like silver.

Chirag Thakkar, Director at Amrapali Group, expects India’s physical silver imports to surge in the coming months, potentially reaching 6,500-7,000 tonnes by the end of the financial year.

He anticipates silver prices may average around $35-$37 per ounce, with peaks as high as $40 per ounce, driven by strong local demand and favorable global monetary policies.

So, can silver outperform gold in 2025?

The question of whether silver will surpass gold in 2025 depends largely on the evolving economic landscape.

Silver’s strong recent performance and favourable short-term drivers make it an attractive option, especially for those with a higher tolerance for risk.

However, Value Research and Capitalmind both emphasise gold’s superior track record in terms of consistency and volatility management.

For risk-tolerant investors, a small allocation to silver could enhance returns, especially if silver sustains its current upward trend. However, for those seeking stability, gold remains the safer hedge.