The Lok Sabha on August 7 passed the Finance Bill 2024 and amended the long term capital gains tax provision on immovable properties giving taxpayers an option to switch to a new lower tax rate or stay with the old regime that had higher rate with indexation benefit.

The government’s revised budget announcement allows taxpayers to pick between a 12.5% Long-Term Capital Gains (LTCG) tax rate without indexation and a 20% rate with indexation, for properties purchased before July 23, 2024.

Real estate and tax experts welcomed the move, saying that the move is expected to stimulate investment and sales in the housing market by potentially reducing the tax burden on sellers.

“The government’s amendment to not enforce the revised taxation rules on long term capital gains arising out of sale of land and buildings retrospectively is expected to boost investors’ and homeowners’ sentiment and thus the real estate sector at large,” said Vimal Nadar, Senior Director and Head of Research, Colliers India.

At a time when housing sales are stabilising at higher levels than the past average, this amendment is timely and will aid in allaying concerns around taxability of capital gains, he said.

“This change gives homeowners flexibility in their tax liabilities when they sell their property. For properties held over a long period, where inflation has majorly raised the property’s value, opting for the 20% tax rate with indexation would be beneficial. Indexation adjusts the purchase price for inflation, potentially reducing the taxable gain and overall tax liability. For properties held for shorter periods or in low-inflation periods, the 12.5% rate sans indexation could be more beneficial and result in a lower tax burden,” explained Anuj Puri, chairman, Anarock Group..

This revision can potentially stimulate the residential property market because it provides clarity and implies potential tax burden reduction. Homebuyers’ sentiment will improve as they have flexible options for addressing their future capital gains tax burden. This will result in higher demand, particularly in markets where property values have been seen to rise significantly, he added.

This amendment is expected to stimulate investment and sales in the housing market by potentially reducing the tax burden on sellers. It reflects a progressive approach by the finance minister to encourage growth in the real estate sector, said Shishir Baijal, Chairman and Managing Director, Knight Frank India.

“This move offers flexibility for sellers, who can now choose the option that best suits their financial situation and the extent of their property’s appreciation. While the 12.5% rate may seem immediately attractive, the decision to opt for it or the 20% rate with indexation should be made after careful consideration of individual circumstances. Ideally, if a property’s value has significantly outpaced inflation, the 12.5% rate might be more beneficial. However, indexation could be advantageous in cases where property appreciation is closer to the inflation rate,” he added.

This amendment will specially give relief to the middle-class who are quite sensitive about any tax policy changes and the changes in financial structure. By maintaining the cycle of selling and buying, this can foster increased liquidity and a greater sense of optimism within the real estate sector, said Ritesh Mehta, Senior Director, and Head (North and West) – Residential Services and Developer Initiative, India, JLL.

Anshul Jain, Chief Executive, India, SEA & APAC Tenant Representation, Cushman and Wakefield said that “Providing an option of choosing between the two tax regime is a welcome move.”

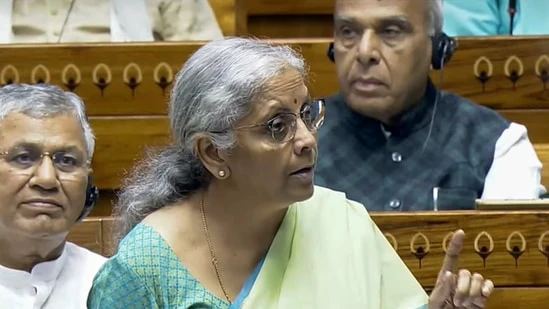

Finance Minister Nirmala Sitharaman, who in her Budget for 2024-25 proposed to lower the long-term capital gains tax on real estate to 12.5% from 20% but without the indexation benefit, moved an amendment to the finance bill on August 7 to give the option to tax payers. Indexation benefit allows taxpayers to arrive at the cost price of the property after adjusting for inflation.

The amendment came after the new provision was criticised for raising tax incidence and disincentivizing investments in the real estate sector.

The amendment

The major amendment in the Bill relates to restoration of indexation benefit on sale of properties bought prior to July 23, 2024. Now, individuals or HuFs who purchased houses before July 23, 2024, can opt to pay LTCG tax under the new scheme at the rate of 12.5% without indexation or claim the indexation benefit and pay 20% tax.

The Lower House later approved the bill with 45 official amendments by voice vote. The Finance Bill 2024 will now go to the Rajya Sabha for discussion

Finance Minister Nirmala Sitharaman on August 7 said that the current amendment with regard to the long term capital gains tax proposal on real estate is to ensure there will be no additional tax burden with regard to LTCG tax on real estate sale.

The current amendments ensure there will be no additional tax burden with regard to LTCG tax on real estate sale, she said.

“We did not remove the indexation benefit on LTCG tax to increase revenue; rollover provision exists if capital gains are invested in new properties,” she said in her response to the discussion on the Finance Bill in the Lok Sabha.

She said that the long term capital gains tax proposal on real estate is being amended to give options to taxpayers to compute tax liability under the old system or at reduced rates without indexation, and pay the lower of the two.

Taxpayer can compute liability on sale of land, buildings acquired before July 23, 2024, on lower of the new and old LTCG tax rates, she said while replying to a debate on the Finance Bill, adding that the rollover benefit will be available to taxpayers who buy new immovable property utilizing the capital gains on the sale of old property.

“We have yielded to the voices. We have the courage of conviction to change. Amendments in the budget are brought in even later so that it is representative of common people’s aspirations,” she said.