With the deadline for linking PAN and Aadhar cards closing on June 30, a number of NRIs have been left with PAN cards that are now ‘inoperative’.

This has caused distress and inconvenience as many non-resident Indians (NRIs) have had their investments frozen and some have been unable to file their tax returns.

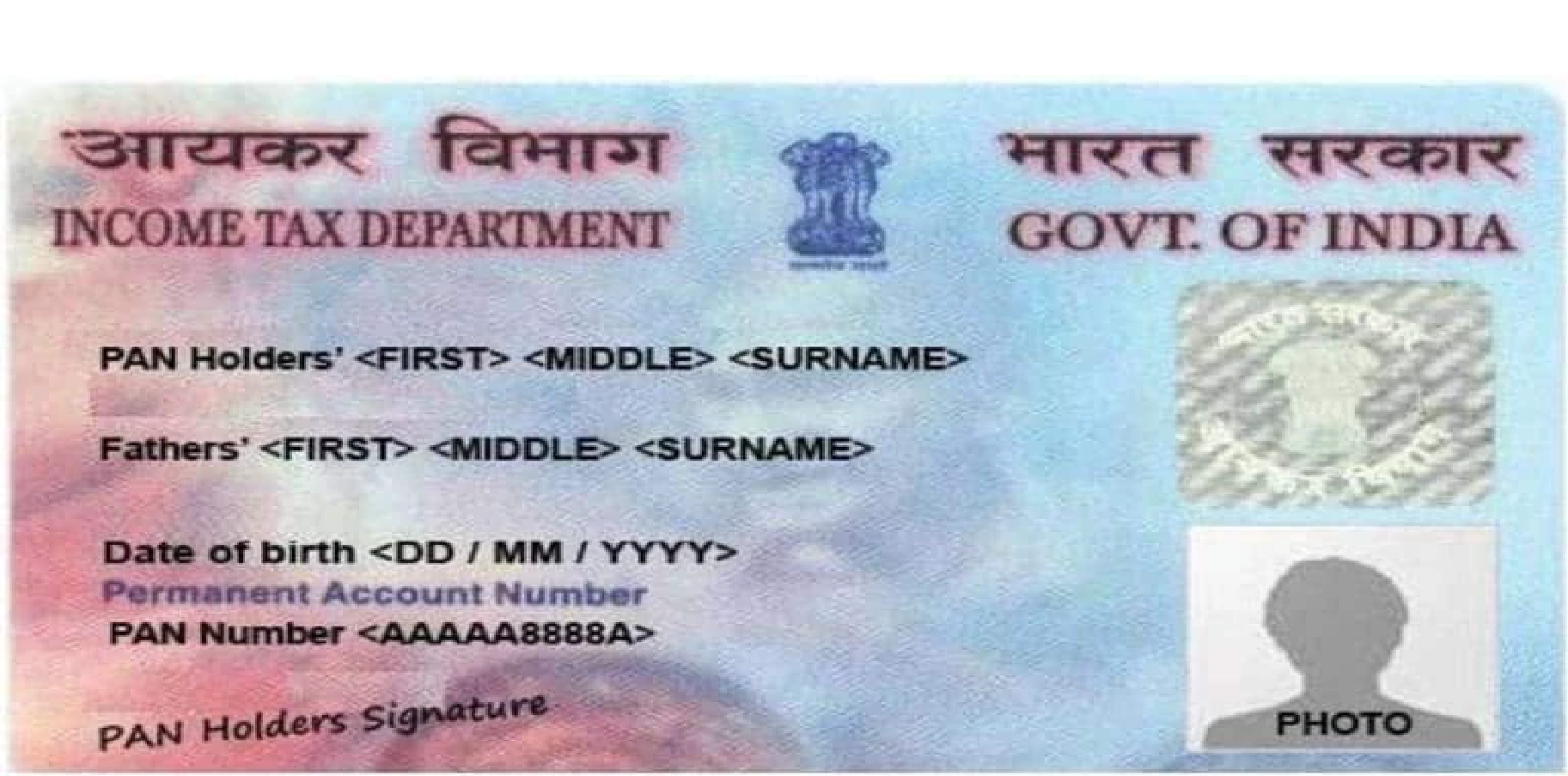

If a person is eligible to obtain an Aadhar Card number, it is mandatory to link it with their PAN card, under the Section 139AA (2). However, NRIs are not required to obtain an Aadhar number. They are also not required to link their PAN and Aadhar numbers, but the Income Tax Department has mandated that NRIs have to update the income tax portal on their residential status even if they are filing taxes for past few years as Non Residents and have been registered at NSDL as NRIs.

The impact of PAN-Aadhar linking was primarily focused on domestic income taxpayers and did not directly apply to international taxpayers.

Overview of PAN-Aadhar linking for NRIs

Earlier, NRIs were concerned that non-linking of PAN and Aadhar cardswould lead to heavy penalties in the form of higher TDS, TCS, and so on. But there has been a lot of confusion since July 1, when many NRIs found their PAN card inoperative even after completing the necessary formalities. Therefore, it is necessary to clarify the guidelines and specify the imposed obligations on NRIs.

The rules mandate that NRIs must notify the IT department about their NRI status by submitting an application. Ideally, the IT department should map the residential status from ITR or NSDL data but it appears to be an intentional drive to seek the notification from NRIs.

NRIs will not be able file an IT return after the 31st July deadline unless the CBDT extends it specifically for NRIs. One can file a belated return after 31st July if the PAN is made operative on the basis of an application with a penalty of Rs. 5,000.

Know the nuts and bolts of income tax return-filing process for FY22-23

Impact of an inoperative PAN for NRIs

The inoperative PAN cards of NRIs have brought about various repercussions on their financial transactions. Since July 1, many NRIs have had to deal with disruptions in processing mutual fund systematic investment plans (SIPs). The Association of Mutual Funds in India (AMFI) has explicitly stated that investors with inactive PAN cards cannot initiate new transactions in SIPs, systematic transfer plans (STPs), and systematic withdrawal plans (SWPs). Consequently, these investors may encounter rejection of redemption requests and may be unable to claim their dividend payouts.

Furthermore, the prevailing chaos has hindered NRIs from successfully filing their income tax returns (ITRs), thereby depriving them of pending tax refunds. Moreover, NRIs are no longer eligible to request the issuance of lower Tax Deducted at Source (TDS) certificates from the IT department, which previously allowed them to mitigate the impact of high TDS rates (ranging from 20 percent to 30 percent) on activities such as rental income, property sales, andNon-Resident Ordinary (NRO)account transactions.

ITR filing: Switching between old, new tax regimes possible, with some hassles

NRIs play a significant role in bolstering the Indian economy. They not only enhance the country’s global image as a soft power but also contribute to its financial strength through inward remittances. These remittances constitute nearly three percent of India’s GDP. NRIs’ investments in mutual funds, shares, and bonds contribute to India’s foreign exchange reserves. Any disruption in the inflow of remittances can have adverse effects on India’s macroeconomic stability.

ITR filing: How to file income from capital gains or set off capital losses

The next steps

As per the recent statement shared by the IT department, the NRIs with inoperative PAN are required to complete certain formalities in order to get their finances on track. They are required to present supporting documents including – a copy of their PAN card and a copy of their passport to show their residential status and period. This will help the IT department to know and update their residential status in their PAN database.